You’ve heard it before – all the benefits of investing – to start investing sooner rather than later, compounding returns, improves spending habits, etc. You want to start, but the lack of knowledge, and “risk” is scary. We get it. That’s why we’re here to help. In this article, we’ll show you the exact building blocks you need to get started.

First things first, let’s get scary out of the way because the scariest part of investing is starting. Investing is not scary. Yes, all investing inherently involves risk — if there was no risk, you’d just be “saving,” earning almost zero return, and actually losing money over time (what you may be doing now if you’re keeping your cash in the bank). But, one thing is for sure, you will make a lot more money if you invest than if you keep it in the banks.

Not sure where to start? For the first time investor, we recommend using a robo advisor to invest. Sometimes referred to as robo-investing or simply robo, this type of online service uses computer algorithms to select a diversified investment portfolio designed specifically for you. Unlike your typical human financial advisor, robo advisors are automated platforms that create investment portfolios tailored to you based on your financial goals and comfort level. Robo investors make it really easy to invest online. They do the research for you, and if there’s a change in the market, the platforms automatically update to optimize portfolio performance.

This type of investment allows professionals to do the work for you. Think of it as a passive approach to generating returns. This means you don’t have to monitor the stock market on a constant basis and be an active trader. The technology behind the robo will automatically adjust your portfolio for you. Also. While human financial advisors at a big bank will charge you over 1% of your total assets managed, robo advisors, come in around 0.25 – 0.50%.

In other words, it offers a hands-off approach to investing, while still working toward your goals. Pretty genius, right?

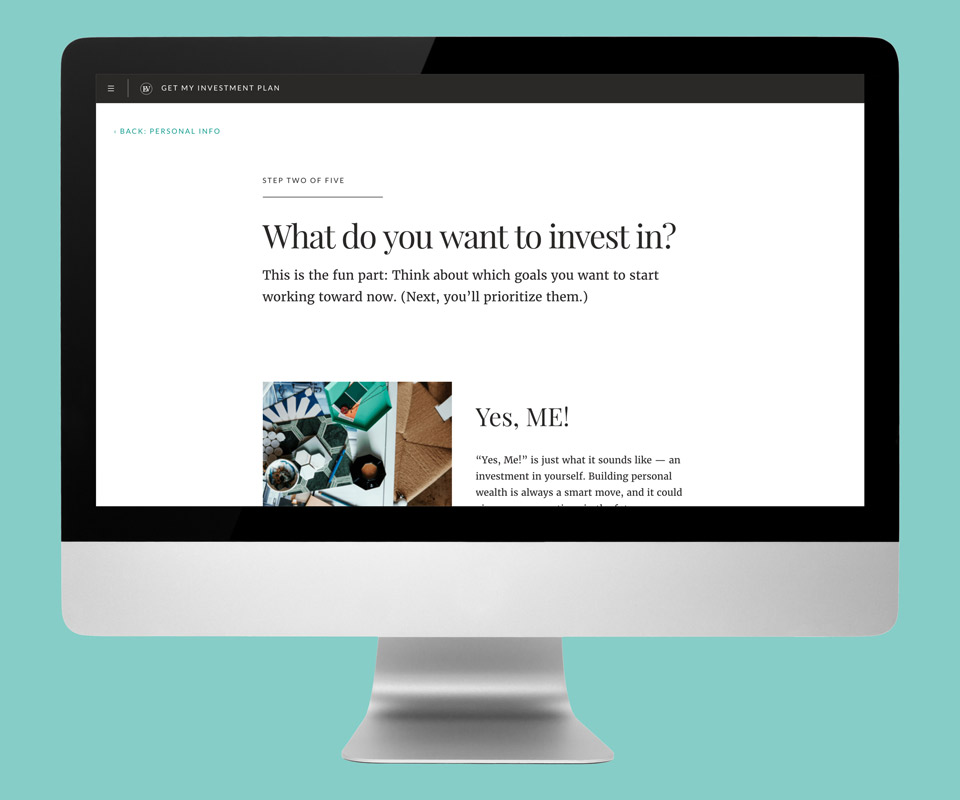

Ellevest, for example, is a robo advisor tailored to female financial needs. At Ellevest, they recognize the unique financial difficulties that women experience, including slower salary growth and increased longevity. They also understand and address why women are more hesitant to invest their earnings than men – the main reason they fall behind in retirement planning.

Starting a robo account is really easy and intuitive. You start off with a quick online survey to determine your financial goals. The digital platform will suggest an allocation of your money into different types of low-cost index funds. You can use their recommendation or adjust to fit your investment preferences. Then you click accept and you’re on your way to fulfilling your goals!

It’s time for women to invest. Here’s how you can get started.

Set Your Financial Goals

Financial fitness, similar to physical fitness, takes dedication and good habits and goals. Speaking of goals, we are huge fans of goal-based investing. Simply put, you pick a specific goal and then invest to meet that goal. What’s great about goal-based investing is the razor focus. You know exactly what you’re saving for and how much.

Keep in mind your goal doesn’t have to be retirement! Maybe you’re saving up for a home or a vacation. The point is, if you contribute regularly towards a goal, you’ll have money set aside when the time comes. Plus, by using a compounding investment vehicle like a robo, you pay less than if you fronted the whole thing in cash.

One thing to remember when choosing your goal is that it is entirely yours. It might be easy to benchmark yourself against friends or peers, but you get to decide where your hard earned money goes. Think about the WHY behind your goal. Studies show that when people save for a tangible outcome, they are more likely to reach their goal.

So say you want to save for a vacation. Think about where you want to go and why. Maybe you love animals and it’s your dream to go international. Maybe you love nature and want to be outdoors. You want something visually stunning and want to experience luxury. How about a safari trip? What will that cost? When do you want to go? Craft out your vacation so the next time you’re tempted to indulge – whether it’s on a coffee or a purse – you can visualize your dream safari. Knowing you’re giving up something right now for a real outcome in the future will help curb spending habit.

The 1, 2, 3 to Set Up Your Investment Account

Ellevest is a great example of a goal based robo investor specifically catered to women. In helping you understand just how easy it is to set up an investment account, let’s give a concrete example on how to open your Ellevest account. Here are the steps:

1. Determine the goal: luxury safari vacation.

2. Determine how much it’ll cost: $5,000 including flights and an all-inclusive glamping resort.

3. Determine how much you can contribute now: $1,000.

4. In Ellevest, select the goal “Once-in-a-lifetime splurge” and fill in the deets: $5,000 goal with $1,000 starting deposit

That’s all! Ellevest will help you calculate how long it’ll take and how much money you’ll need to set aside each month to reach your goal.

A great feature Ellevest has is the ability to adjust your risk tolerance. They will suggest a basic guide and you can adjust your risk to be more aggressive or more conservative. Selecting a more aggressive plan could put you toward your vacation faster, but it also means your money is more affected by stock market volatility.

In this scenario, with an aggressive risk tolerance, Ellevest suggests you contribute $60/ month for a dream vacation in 5 years. Compare that to simply putting cash in an envelope. If you put save $60/ month for 5 years (with a $1,000 start), you’ll only have $4,600.

Oh! And did we mention Ellevest will give you $100 to jumpstart your goal?

Start Funding Your Account

Now, it’s time to start funding your account, but how much exactly? You should target saving 20% of your salary from your very first paycheck. This may sound like a lot — especially if you are save nothing nothing now. But years of research shows that people who save at this level are much better equipped to ride the ups and downs of the economy — and life — than others.

If you really can’t save 20%, start with 1%, then work your way to 2% and then 5%. The goal is to eventually be setting aside 20% of every paycheck to Future You. It doesn’t have to be all-or-nothing to have an impact. Just get started.

Your first savings milestone is to build an emergency fund. This should be at least three months of take-home pay, in case you get fired or your roof falls through (hey, it happens — more than any of us like to think), or in case you have to take time away from work for, you know, an emergency. That money should be held in cash, for safety.

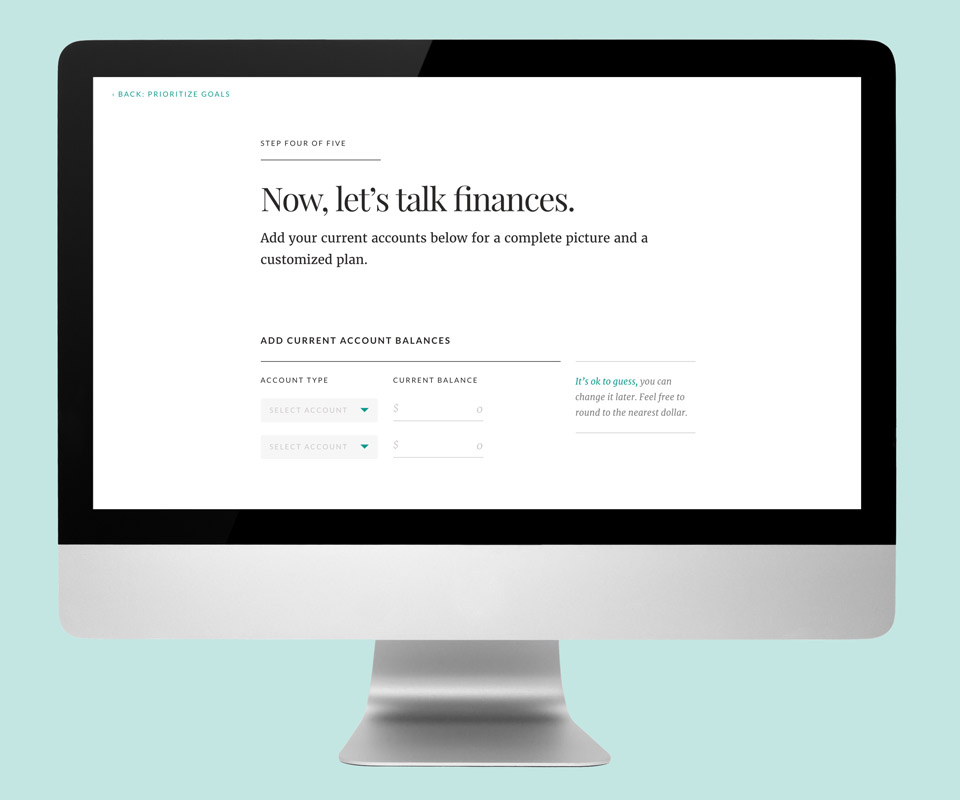

To fund your account, simply click the “Invest Now” button. Ellevest does not require a minimum for their basic Ellevest Digital services, so you can start a fund with as little as $1. The website will ask you fill out some personal information. Here’s what you should gather to make the process easier:

Contact information (your address and phone number)

Social security number

U.S. citizen status

Employment status (name and address of the place you work for)

Your bank’s name

It’ll then take you to a page that asks you to log in to your bank account. This will link your bank to Ellevest. You can also link your bank account by manually entering in your bank account number and routing number. If you input your information manually, there will be 2 tiny test deposits, usually less than $0.05, transferred into your bank account for you to validate.

Once your bank account is set up, Ellevest will ask which one of your goals you want to start with. You confirm your initial deposit and decide whether you want to set up auto transfers. Ellevest gives you the option of setting up recurring auto deposits. You can choose to automatically transfer money from your linked bank account every two weeks, every month, or quarterly. Or you can make one-time manual deposits whenever you feel like it.

Then you’re all set! Easy peasy! Ellevest might take a few days to confirm your identity and bank account, but the hard part is over.

When you reach your goal, it’s time to celebrate! Hooray! Unlike other brokerage firms, Ellevest allows you withdraw all your money at any time without a fee. Their processing system takes about 7 business days for your money to transfer back to your bank account. Start packing those bags and remember your hat and sunscreen!